Mobile money has the potential to change the lives of millions

SEE MADINA'S STORYToday, there are 2.5 billion unbanked people worldwide. All of them lack access to powerful financial services. Mobile money offers that access and a potential way out of poverty. But there’s a problem: only 1/3 of those who sign up for mobile money actually use it. Why?

For low-income people, money is a matter of survival. Asking them to switch from cash to mobile money isn’t just a rational decision; it’s a high-stakes emotional one too. With this reality in mind, the sector has already invested a lot of time, energy, and care into building out the mobile money system.

But for mobile money to truly succeed, it’s not enough to improve how it works; we must also improve how it feels.

So we asked ourselves: how could we get to the heart of mobile money?

When we looked into mobile money, we found two missing emotional elements:

Trust

There isn’t much faith in how mobile money works or opportunities to understand it, a combination that’s led to a lack of trust in all sorts of places.

Value

Rarely does mobile money seem more worthwhile than cash. There’s little (perceivable) reason for people to care about it at all.

-

On Trust

"[My customer] was so hurt before… I said, I will be good to you, if you're good to me.… he became my friend. Almost a brother."

— AGENT IN UGANDA -

On Trust

"I feel like I’ve related to [my customers]. I am really giving them something."

— AGENT IN UGANDA -

On Value

"It's on my phone but is it real?"

— CUSTOMER IN TANZANIA

[when asked about health insurance through mobile money]

To overcome these obstacles, we turned our focus to oft-overlooked (and sometimes entirely absent) players — a mix of people, touchpoints, and tools — in the system to transform mobile money into a powerful tool that can help those with the most to gain.

There isn’t much faith in how mobile money works or opportunities to understand it, a combination that’s led to a lack of trust in all sorts of places.

Who's at the Heart of Trust?

There isn’t much faith in how mobile money works or opportunities to understand it, a combination that’s led to a lack of trust in all sorts of places.

What’s at the Heart of Value?

When it comes to integrating mobile money in their lives, people struggle to answer a very understandable question: why should I risk trying this when I’m so much more comfortable with cash? Expecting someone to put faith (and money) in a system that’s complicated, error-prone, and unfamiliar is a big ask.

So how can we help people trust there’s something to gain from changing their financial habits to favor mobile money?

IT TURNS OUT, building trust is a tricky process that brings up all kinds of feelings — skepticism, fear, confusion, frustration. Navigating these emotional hurdles and building a solid foundation of trust is a tall order. But we found a surprisingly simple way to do it, employing a solution so obvious we almost missed it: people. People with smiles to reassure you, ears to hear you out, and hands to guide you. Someone with a familiar face to trust.

What if we said there were already millions of people poised to build trust in mobile money... and all we had to do was activate them?

Those people exist, and they’re everywhere:

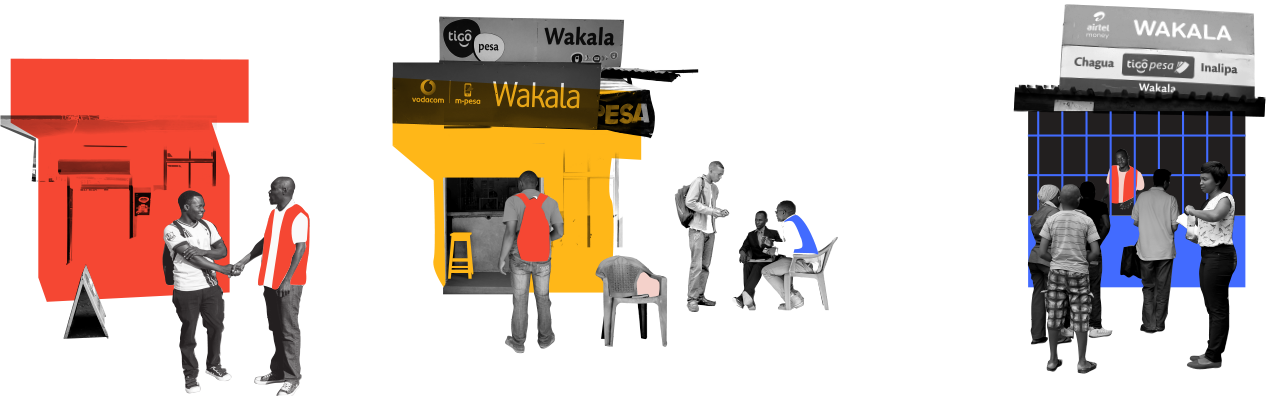

Mobile Money Agents

BUT RIGHT NOW, agents are basically used like human ATMs. We believe agents can be so much more. Through person-to-person interactions, an engaged presence in the community, and knowledgeable guidance on real issues, agents can help customers get comfortable using mobile money everyday.

If we want to leverage agents as trust-builders, we can't expect them to step up on their own. We need to help them become the mobile money ambassadors they're so well-positioned to be — empowering them with better tools, smarter data, and more worthwhile incentives. We need to help them to trust mobile money themselves, too!

ONCE WE SUPPORT THESE CHANGES, customers will begin adopting mobile money, eventually becoming confident and savvy users able to navigate the system without help.

As this shift takes effect, smartphones will continue becoming more affordable and widespread. As we know, this technology will make mobile money more accessible to customers and agents alike. While we continue working on the technology that will eventually pick up where agents leave off, we can jumpstart the trust-building process. We can help agents become the people who get users onboard with mobile money today.

Here are three ways to build trust in mobile money by activating agents:

If we want people to understand the promise of mobile money — that it can help them plan and save for the future — we have to first show them that it has real value. It has to be clear that there are compelling reasons for funds to be transacted digitally and saved digitally.

How might we demonstrate the value of mobile money by helping people see how integrating it in their daily lives offers greater long-term benefits than cash?

THIS POSED A DESIGN CHALLENGE. Right now, the mobile money system is incomplete; places to spend don’t always exist, and often there isn’t a distinct incentive for customers or suppliers to invest in mobile money. In theory, mobile money offers a route to financial success. In reality, it often leads to a series of dead ends.

What if there were someplace to work these problems out, where we could successfully demonstrate mobile money’s value to all... and then apply the lessons we learned in that setting everywhere?

That perfect place existed in a place you might not expect

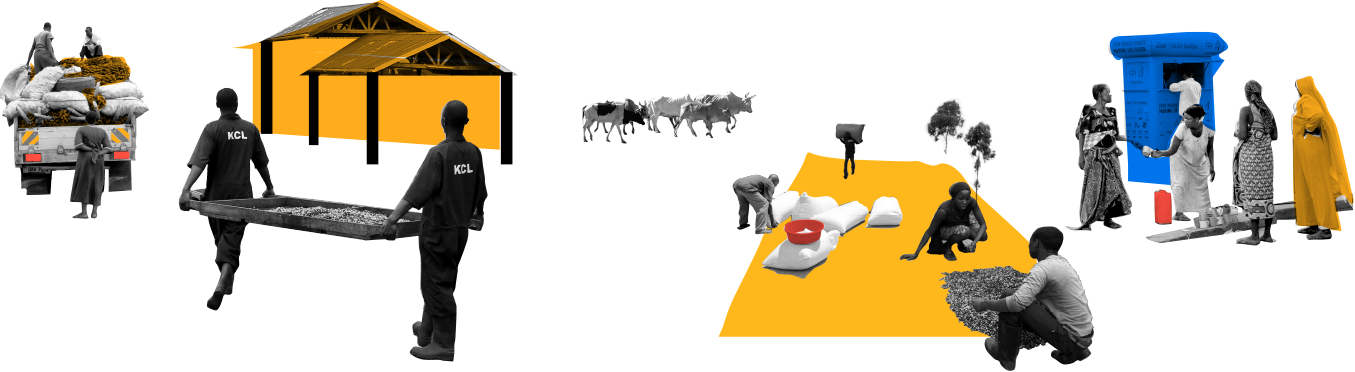

The Coffee Value Chain in Rural Uganda

THERE, WE DESIGNED A FULL-CIRCLE mobile money experience for coffee farmers, buyers, and surrounding merchants. We even had a head start — coffee buyers could already pay farmers digitally using a bulk payment system. It was up to us to figure out how we might encourage farmers to accept payments at harvest in mobile money and keep the money on their phones instead of cashing out immediately. Once that piece was in place, we focused on creating connections within the existing ecosystem to ensure mobile money was a win-win for everyone.

OUR EXPERIMENT REVEALED the necessity of connecting a variety of mobile money users and building a few new ways to use mobile money that didn’t exist before. By tackling both challenges, we were able to show farmers and suppliers alike that mobile money could be relevant and useful in their daily lives.

The key was a holistic approach. It wasn’t enough to imagine singular fixes; making mobile money work meant engaging everyone to create popular demand, which opened up more opportunities for the system to evolve and improve overall.

MAKING MOBILE MONEY WORK in this Ugandan “pocket universe” leads us to believe we can scale this same approach up and out to other value chains. While the players and pain points will differ in each new place, designing for the sum of the parts will unlock the people-based power of mobile money everywhere.

Here are three ways to demonstrate the value of mobile money through the ecosystem:

Human-Centered Design can accelerate the growth of mobile money and benefit the poor

IN 2015, The Bill and Melinda Gates Foundation and IDEO.org partnered to improve mobile money for low-income people in East Africa using Human-Centered Design. Over 1.5 years, IDEO.org partnered with innovative organizations, conducting research to deeply understand customers, designing and testing new solutions, and bringing digital financial offerings to market. We partnered with Airtel, Jamii (formerly BimaAFYA), and Vodacom in Tanzania and with Kyagalanyi Coffee Limited, Yo Uganda, and United Nations Capital Development Fund (UNCDF) in Uganda.

This website highlights key outputs of the Human-Centered Design process and themes that emerged when we looked at mobile money adoption across contexts.

WHO'S IDEO.ORG?

IDEO.org is a nonprofit design organization that works to empower the poor. We believe that by understanding and working alongside those in the greatest need, we can design solutions that create prosperity. Partnering with nonprofits, social enterprises, and foundations, IDEO.org practices human-centered design to solve some of the world's most difficult problems.

WHAT’S HUMAN-CENTERED DESIGN?

Human-centered design is a creative approach to problem solving. It's a process that starts with the people you're designing for and ends with new solutions that are tailor made to suit their needs.

We’re using a variety of methods to design and learn

A MORE USABLE MOBILE MONEY INTERFACE

IDEO.org designed, tested, and iterated a range of features for USSD and smartphone mobile interfaces, based on common pain points and barriers to mobile-money use experienced by customers and agents. By making new ideas tangible and inviting users to interact with them, we gained valuable feedback to design digital financial services that are more accessible and desirable for low-income, low-literacy, and rural customers.

LIVE PROTOTYPING WITH BIG DATA

In Tanzania, IDEO.org leveraged data science to produce quantitative analyses that complement our qualitative research and insights, in partnership with data science firm DrivenData. By looking at a range of data sets, including mobile-money accounts, CDR, network data, etc., we uncovered and tracked patterns that informed the design and testing of improved products and services.

NATIONWIDE DATA GATHERING

In Uganda, IDEO.org commissioned a national survey to understand customers’ financial behaviors and uses of mobile money to complement our qualitative research, in partnership with Ugandan research firm Knowledge Consulting. This survey was conducted in January 2016 with 1,456 respondents, yielding a rich body of responses and findings that informed our approach to improving mobile money in this market.

01

LOYALTY

01

LOYALTY

Encourage Lasting Relationships

A familiar face can make the difference. When we give agents and customers engaging ways to build lasting relationships, it drives growth. These connections also help customers feel comfortable enough to try out new financial behaviors.

AGENT LOYALTY DRIVES GROWTH

The more times a customer visits the same agent the more money they’re willing spend in a transaction.

After 10 visits, transaction size was 22% higher.

Source: Data provided by Airtel Tanzania, Jan–March 2016AGENT LOYALTY DRIVES GROWTH

The more times a customer visits the same agent... ...the more money they’re willing spend in a transaction.

- 1 visits

- 2 visits

- 5 visits

-

+22%

10 visits - 15 visits

-

+36%

20 visits

Building loyal relationships with customers compels them to use mobile money more, and even transact at higher values. A small percentage of top-performing agents have figured this out. To encourage this relational approach throughout the network, carriers can recognize and reward agents for their good work.

How might we give agents reasons to offer five-star service and keep customers coming back?

Pamoja Loyalty Program

To incentivize agents to build stronger relationships with customers, we partnered with Airtel Tanzania and designed Pamoja to help both the agent and customer feel rewarded for using mobile money. First, customers choose an agent they prefer. After they visit this agent several times, they get a cash prize for loyalty. To make things interesting, the more times a customer visits that agent, the more chances they get to win a bigger bonus.

AGENTS ALSO RECEIVE a monetary incentive for being preferred by customers, encouraging them to maintain relationships through attentive service and keep customers coming back for more.

“I memorize my top 10 customers’ phone numbers and PINs. It makes them feel great and really happy that I know them.”

Design Principles to Encourage Lasting Relationships

Reward customers for frequenting one agent they prefer and incentivize agents to offer better service to keep customers coming back.

REWARD AND RECOGNIZE GOOD SERVICETrack agents by the number of loyal customers they keep and reward agents who perform well.

MAKE LOYALTY DELIGHTFULAppeal to people’s appetite for games by offering a chance to win rewards for loyal customer habits.

Agents expressed enthusiasm about using programs to boost business. They liked that the rules were simple and easy to remember. Customers were excited by the chance to win.

Airtel Tanzania plans to launch the Pamoja loyalty-rewards program in 2017, in conjunction with their network of rural and peri-urban franchises.

02

SECURITY

02

SECURITY

Build Moments of Reassurance

When using mobile money today, so many things can go wrong. Simple mistakes are both common and catastrophic. Both customers and agents need reassurance that mobile money is secure.

STRANGER DANGER

One of the most common errors is from an incorrectly entered digit in a recipient’s phone number.

STRANGER DANGER

One of the most common transaction errors... ...results from an incorrectly entered digit in a recipient’s phone number.

Smarter technology, thoughtful design, and agent support can reduce human error and quell distrust, making mobile money a seamless experience for all. We took the opportunity to address limitations of both basic phones and the USSD menu to solve for the persistent problems of mobile money through a new smartphone experience.

How might smartphone technology reassure customers and agents that mobile money is secure?

Agent Smartphone App

In Uganda, we designed a smartphone app for agents to streamline workflows, reduce errors, and even catch fraud. The richer visual interface of the smartphone enables a guided experience for both agents and customers. The app prompts agents at key moments to collect or give cash to customers and enables customers to review and approve transactions, while giving clarity on fees.

FRAUD IS A CONSTANT CONCERN, limiting the amount of money people are willing to put on mobile apps and leading to regular financial losses for agents. A smartphone app can create a protected experience by detecting numbers associated with suspicious activity, sending preventative alerts, and monitoring activity throughout the system, protecting agents and customers against fraud and making mobile money feel even more secure than cash.

“Do I have to confirm?”

PAUL, AGENT:“No, both of us do! This is really good. It will help reduce the time.”

Design Principles to Build Moments of Reassurance

Provide a guided flow that avoids common mistakes. Give customers visibility at key moments, like when confirming transactions.

HELP AGENTS STAY AHEAD OF FRAUDFlag potentially high-risk activity in the system and notify agents of the latest fraud schemes.

GIVE AGENTS EASY ACCESS TO HELPConnect agents to automated and scalable customer service through familiar WhatsApp-like digital channels.

We heard from agents in Uganda that the visual smartphone interface offered a better experience than USSD. Favorite features included seeing float balance on the home screen, reminders that reduced mistakes, access to a longer transaction history, and anti-fraud protections.

IDEO.org made the app design available to the public in mid-2016 as as a way to inspire further innovation in the sector.

03

VISIBILITY

03

VISIBILITY

Empower Agents with Information

If agents don’t trust mobile money in the first place, we can’t expect them to convince their customers to trust it either. Currently, agents feel like there’s no correlation between the transactions they make and how much they earn, which makes agents suspect carriers of tampering with their rightful commissions.

THE WILD RIDE OF AGENT COMMISSIONS

Agents perceive commissions as unpredictable. Earnings can vary as much as 150 percentage points from week to week.

Source: Data provided by Airtel Tanzania, Jan–March 2016

Source: Data provided by Airtel Tanzania, Jan–March 2016

THE WILD RIDE OF AGENT COMMISSIONS

Agents question their earnings: Data showed wild swings in earnings from week-to-week.

“I’m not sure how much I am getting but it feels like less than what I deserve compared to the transactions I have made.”

Source: Data provided by Airtel Tanzania, Jan–March 2016

If we give agents more visibility into how their earnings fluctuate and better tools to track their business, we can help them see the big picture and optimize their potential.

How might we put agents in control of their business earnings today and in the future?

Agent Commission Reports

We designed a Commission Report, in partnership with Airtel Tanzania, to give agents an easy way to see their earnings and other information that can optimize their business. Agents can see daily or weekly business activity, understand when commissions are running high or low, and make a direct connection between performance and profit.

THE REPORT LEVERAGES DATA captured in Airtel’s system and delivers it to agents in ways that address common pain points. Agents can see their peak hours and even predict future foot traffic. This helps agents better prepare for the busiest times, e.g., to have enough cash (float) on hand so they can serve every customer who comes their way.

Design Principles to Empower Agents with Information

Give agents tools that show them their commissions on a regular basis.

GIVE AGENTS TOOLS TO OPTIMIZE THEIR BUSINESSShow simple data trends that can help agents run their business more smoothly, like customer-traffic data that helps agents plan for peak hours.

MAKE AGENT SUPPORT A PART OF THE BOTTOM LINEOffer small gestures of support, from simple tools to encouraging communications.

Agents were excited about the ability to check commissions at any time, to see their history by day, week, or other timeframe, and to predict future traffic.

IDEO.org developed the commission report and Airtel Tanzania is currently implementing a build of the product.

01

SYNERGY

01

SYNERGY

Align Stakeholder Motivations

Everyone with a stake in mobile money has to feel like they’re getting something out of it. Those benefits are going to be different for all involved, but working towards a way to make everyone happy with mobile money is the key to its success.

When we looked at the coffee value chain in Uganda, some stakeholders, like coffee buyers, experienced mobile money’s benefits. Others, like farmers and merchants, didn’t. That was the problem — because mobile money wasn’t working for everyone, it couldn’t really work for anyone.

CURRENT STATE FUTURE STATE

When uptake of bulk payments hits an impasse... ... a missing piece can align a variety of interests, closing the loop.

FUTURE STATE

When uptake of bulk payments hits an impasse, a missing piece can align a variety of interests, closing the loop.

Coffee Buyer

Farmers are asking to be paid in mobile money, making the business more efficient, secure, and accountable.

Coffee Farmer

Now I have a reason to keep a balance on mobile money — I can use it to buy things I care about.

CARRIER

There’s unexpected growth happening in rural areas. We should add more agents and infrastructure there.

Mo’AGRO

If I set up a Mo’Agro shop right where the customers are, I can run a profitable, mobile-money based business.

If we can align the motivations and interests of all mobile money users, we can foster a harmonious and self-sustaining ecosystem that supports mobile money’s growth. That means fine-tuning the system to ensure it offers win-wins, at every stage, for everyone.

How might we bridge the gaps between stakeholders and encourage everyone to use mobile money?

MoAgro Pop-Up Shop

We created Mo’Agro, the first cashless store only accepting payment in mobile money. Locating the shop where farmers get paid for their harvest offers visible and immediate uses for mobile money, priming farmers to accept digital payments over cash. Mo’Agro offers convenience and access to farmers who would otherwise travel to town to buy supplies and goods, paying for costly round trip transport.

MO’AGRO OFFERS THINGS FARMERS NEED — agricultural inputs and tools — and things they desire — food, school, and books, not to mention personal items like perfume or candy. Likely one of the first rural merchants that accepts mobile money, Mo’Agro is designed as a farmer-centered brand and retail experience that rotates its stock of seasonal items and introduce customers to products that will surprise and delight them.

Design Principles to Align Stakeholder Motivations

Identify the unique concerns and priorities of all actors and make sure the mobile money system accounts for them.

GIVE PEOPLE PLACES TO SPENDCreate commercial contexts where people can pay for goods and services using mobile money.

PROVE MOBILE MONEY IS WORTH ITGive people the opportunity to experience firsthand how mobile money makes life simpler and faster, and offers more opportunities for prosperity.

During prototype testing, 75% of farmers at one Mo’Agro shop topped up their mobile-money balance to make purchases. One farmer even signed up for mobile money after seeing the shop.

UNCDF and Kyagalanyi Coffee Limited plan to live prototype Mo’Agro in Summer 2017, reaching up to several thousand farmers and rural low-income people.

02

REMEDY

02

REMEDY

Reduce Friction in the System

Making mobile money the preferred choice means smoothing out the existing pain points of transactions and making them fast and easy for everyone.

At the coffee washing stations in Uganda, one of the biggest pain points was the process of paying farmers in mobile money. Though bulk payment technology existed, we discovered many staff weren’t using it; the platform was too time-consuming and difficult to figure out. In some cases, using the interface created more work instead of less.

FUTURE STATE

Overly complex systems discouraged staff from using bulk payments until the technology was redesigned to feel intuitive and clear.

Coffee Buyer Employee

Tablets are more integrated into our workflow, making things quicker and more efficient for everyone.

BULK PAYMENTS APP

The tablet app is more seamless for farmers and staff, thanks to intuitive interfaces and resilient technology.

COFFEE FARMER

I’m paid faster and can even receive part of it in mobile money and part in cash.

CURRENT STATE FUTURE STATE

Overly complex systems discouraged staff from using bulk payments... ... until the technology was redesigned to feel intuitive and clear.

All this will make mobile money feel seamless and simple, and when there’s a choice to use cash or mobile money, the better option will be clear: mobile money.

How might we make the payments process seamless by leveraging technology?

Bulk Payment App

We rethought digital bulk payments on a tablet. The tablet app gives coffee buyer staff a more intuitive experience — from signing in with a quick 4-digit PIN to disbursing payments in a few keystrokes. The tablet hardware runs independently of generator power and can directly tap into the cellular network. The tablet app lets staff keep working to process farmer payments during busy harvest times even when the network grinds to a halt.

AS A RESULT, farmers can experience shorter wait times when being paid in mobile money. Since many farmers want to be paid at least partially in cash, the tablet app makes it easy to disburse a split payment of cash and mobile money. Farmers are reassured with both digital and physical forms of payment verification.

“The system ... it saves time. It simplifies everything.”

Design Principles to Reduce Friction in the System

Identify and address existing pain points in transaction flows and build missing infrastructure that expedites mobile money transactions.

ENSURE PROCESSES ARE INTUITIVE AND ACCESSIBLERemove any barriers to comprehension or completion in transaction technology that deter people from choosing mobile money.

DESIGN A TOOL MEANT TO EVOLVEBuild infrastructure, technologies, and products that can be easily modified and improved upon as mobile money evolves.

In a human-centered tablet app, the tablet can save staff time by automatically requesting additional float and cash when balances get low. It can help them run a better operation by displaying daily metrics like cash, float, and daily coffee sales so they’re always aware of the station’s performance.

UNCDF and Yo! Uganda plan to release the tablet app in Summer 2017, disbursing digital payments for up to 11,000 farmers.

03

PROSPERITY

03

PROSPERITY

Contextualize Personal Benefits

Mobile money goes beyond simple send and receive functions — you can pay bills, take out a loan, or save for a child’s education. Being able to do all this adds up to much more value than a simple dollar amount in cash.

When we spoke to coffee farmers in Uganda, we learned that if they didn’t have anyone to send money to or receive money from, they didn’t see how mobile money could be relevant to them. We realized we needed to facilitate some “Aha!” moments that would make people eager to use mobile money and demand more opportunities for digital financial services.

FUTURE STATE

Most people don’t understand the wider benefits of mobile money until they understand it within the context of their lives.

Coffee Farmer

I realize mobile money can help me save in ways that were difficult before with cash alone.

Coffee Farmer

Now I have a reason to keep a balance on mobile money — I can use it to buy things I care about.

COFFEE BUYER

The tablet app is more seamless for farmers and staff, thanks to intuitive interfaces and resilient technology.

COFFEE FARMER

I’m paid faster and can even receive part of it in mobile money and part in cash.

CURRENT STATE FUTURE STATE

Most people don’t understand the wider benefits of mobile money... ...until they understand it within the context of their lives.

So how do we help people see mobile money’s very personal benefits? It starts with providing opportunities to identify situations where mobile money would be useful to each user individually as well as unique goals mobile money would help them reach.

How might we surface the inherent value of mobile money beyond basic transactions?

Financial Planning Lessons

We designed a series of financial planning sessions to help people understand the ways mobile money can improve their farms and help their families. In these sessions, run by coffee buyers during the off-season, financial coaches link various financial literacy concepts to ways mobile money can be used that they might not be aware of, like as a way to put money away by opening a mobile savings account.

COACHES ALSO WORK with people to show how using mobile money can help them achieve specific aspirations, like keeping aside a portion of income to pay school or medical fees, or to purchase a cow.

“I decided to reduce my budget for the whole year, and in the future, when I see that it [my Mo’Kash account] is a quite good amount of money, I’ll use the money to buy a cow before the year ends.”

Design Principles to Contextualize Personal Benefits

Offer dedicated spaces for people to express preconceptions, concerns, and questions about mobile money. Have trained facilitators address these.

LINK MOBILE MONEY TO GOALSDesign opportunities for people to articulate financial aspirations and learn about how using mobile money can help.

BUILD A MOBILE MOBILE-BASED PLANOffer lessons and activities that support the creation of actionable financial goals that incorporate mobile money use.

During prototype tests in Uganda, many participants expressed interest in signing up for a savings and credit product on mobile money offered by MTN called MoKash. And one farmer successfully signed up.

UNCDF, Kyagalanyi Coffee Limited, and Yo! Uganda began live prototyping financial planning sessions in spring 2017, reaching up to several thousand farmers and rural low-income people.